Related Questions

Q3: A consumer maximizes total utility when all

Q4: As in Example 5.1, assume that utility

Q5: Suppose the utility function for goods x

Q115: In the above figure, what is the

Q159: The value of the y-coordinate of a

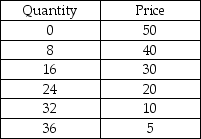

Q160: If there is an inverse relationship between

Q215: In every economic system, choices must be

Q279: The formula for the slope across an

Q303: A negative relationship exists between the variable

Q343: George spends all his income on sandwiches