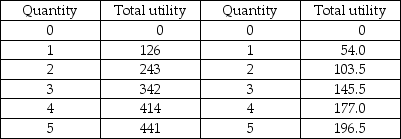

Eclairs Cream puffs

-The table gives the total utility Jamal derives from the consumption of eclairs and cream puffs. Jamal has $12 to spend on these two confectionery goods. The price of an eclair is $3 and the price of a cream puff is $1.50.

a) Jamal's budget is $12. In order for Jamal to maximize his utility, how many eclairs and cream puffs should he buy?

b) Suppose the price of an eclair increase to $6. Jamal's income does not change and neither does the price of a cream puff. What combination of eclairs and cream puffs will Jamal buy now?

c) Using your answers to parts (a) and (b), derive two points on Jamal's demand curve for eclairs.

Definitions:

Pension Plan

A retirement plan funded by an employer, offering income to employees after they retire.

Product Warranty Expense

The cost associated with the obligation of a company to repair or replace defective products sold to customers, recognized as a liability.

Social Security Tax Rate

The Social Security tax rate is a percentage of income that is taxed to fund the Social Security program, paid by both employees and employers.

Medicare Tax Rate

The percentage of an employee's earnings that is withheld by the employer to contribute to the U.S. Medicare program, which provides health insurance to eligible individuals.

Q1: Consider the following game:<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/SM3017/.jpg" alt="Consider

Q12: Team effort<br>Increasing the size of a team

Q19: The United States has a comparative advantage

Q30: In the figure above, the demand curve

Q155: Does Mr. McConaughey's marginal utility from spending

Q230: The above figure shows the apartment market

Q277: Robinson spends all his income on mangos

Q339: In the figure above, the demand curve

Q350: The table above shows Tom's total utility

Q378: A sales tax is divided so that