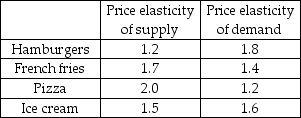

-You are in the business of producing and selling hamburgers, french fries, pizza, and ice cream. The mayor plans to impose a tax on one of these products. Based on the elasticities in the above table, as a profit-minded business person who seeks to avoid taxes whenever possible, which good would you most prefer to have taxed?

Definitions:

Activity-based Costing

A method of allocating overhead and indirect costs to products or services based on the activities that generate those costs.

Overhead Costs

General business expenses that are not directly attributable to a specific product or service but are necessary for the business to operate.

Direct Labor-hours

The total hours worked by employees directly involved in the manufacturing process, used in assigning costs to products.

Activity-based Costing

A costing method that assigns overhead and indirect costs to specific activities, providing more accurate product costing.

Q11: If there is an external cost from

Q54: Lowering the tariff on imported ethanol<br>A) increases

Q58: The gains from trade that are possible

Q65: The Denver Broncos is a football team

Q101: Which of the following can prevent markets

Q154: The tendency of people to value something

Q164: Who benefits from an import quota on

Q291: The above figure shows the market for

Q377: In the figure above, when the market

Q385: Which of the following outcomes is NOT