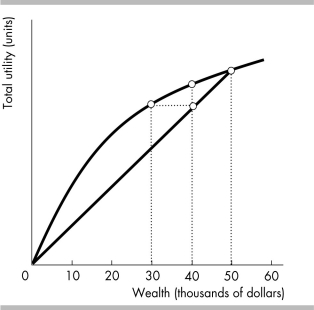

-The above figure shows the utility of wealth curve for a homeowner whose only possession is a $50,000 house. If there is a 20 percent chance that the home could be entirely destroyed, the highest price for insurance this person would pay is

Definitions:

Quick Ratio

A financial indicator that measures a company’s ability to cover its current liabilities without relying on the sale of inventory.

Current Liabilities

Short-term financial obligations that are due within one year or within the normal operating cycle of a business.

Transactions

The exchange or transfer of goods, services, or funds between two or more parties, which are recorded and documented in accounting.

Warranty Work

Warranty work involves repairs or replacements offered at no charge, covered under a product's warranty period to correct defects or malfunctions.

Q37: Ashton has the utility of wealth curve

Q48: The price of a gallon of milk

Q114: In order to societies to reap the

Q120: Resource use is allocatively efficient when marginal

Q211: As an economy's capital stock increases, the

Q220: James has a utility of wealth schedule

Q224: Agnes can produce either 1 unit of

Q311: When the production possibilities frontier bows outward

Q336: Long-distance travel by bus is an inferior

Q369: One of the largest categories of exports