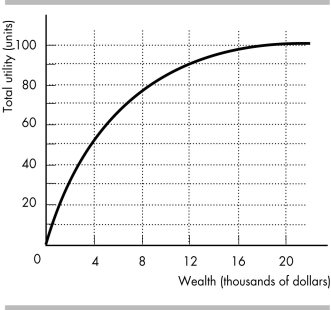

-Larry owns a car worth $20,000, and that is his only wealth. There is a 10 percent chance that Larry will have an accident within a year. If he does have an accident, his car is worthless. Larry's utility of wealth curve is shown in the figure above. An insurance company agrees to pay a car owner like Larry the full value of his car in case of an accident if the car owner buys the company's insurance policy. The company's operating expenses are $2,500 per policy.

a) What is Larry's expected wealth?

b) What is Larry's expected utility?

c) What is the maximum amount that Larry is willing to pay for car insurance?

d) What is the minimum premium that the insurance company is willing to accept?

e) Will Larry buy the insurance policy? Why or why not?

Definitions:

Work

A range of activities involving mental or physical effort done in order to achieve a purpose or result.

Harold Geneen

A prominent business executive known for his role in transforming ITT Corporation into a major conglomerate during the mid-20th century.

Job Enrichment

Designing or redesigning a job by incorporating motivational factors into it.

Differentiation

A strategy or process that involves making a product or service distinct from those of competitors, often through innovation or quality improvement.

Q14: For a risk-averse individual, as wealth increases,

Q21: The distribution of U.S. income is NOT

Q37: Which of the following does NOT help

Q39: The principle of increasing opportunity cost leads

Q66: The figure above shows the market for

Q237: In the above figure, which of the

Q316: The "mode" household income is<br>A) the income

Q343: In the above figure, in order for

Q428: The table above shows the marginal benefit

Q463: If the demand curve for bottled water