-Tammy sells woolen hats in a perfectly competitive market. The marginal cost of producing 1 hat is $24. The marginal cost of producing a second hat is $26 and the marginal cost of producing a third hat is $28. The market price of a hat is $26. To maximize profit, Tammy produces ________ per day.

Definitions:

Qualified Pension Plan

A retirement plan that meets requirements established by the Internal Revenue Code, offering tax advantages such as tax-deferred growth on earnings.

Ordinary Income Rates

Tax rates applicable to an individual's ordinary income, including wages, salaries, commissions, and income from interest or dividends, which are taxed at progressive rates.

Employee Contributions

Employee Contributions are amounts set aside from an individual's earnings into retirement plans, benefit plans, or taxes, often deducted directly from their paycheck.

Tax-deferred Retirement Plans

Savings plans that allow individuals to postpone paying taxes on income invested until it is withdrawn, typically during retirement.

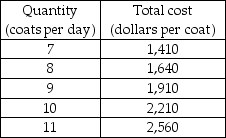

Q47: In the above figure, the marginal cost

Q141: Total fixed cost is the sum of

Q154: The short run is a time period

Q169: If the price is $12 per pizza,

Q183: A perfectly competitive firm will have an

Q186: Efforts by a firm to obtain a

Q187: The figure above provides information about Light-U-Up

Q218: A perfectly competitive firm produces so that

Q228: A perfectly competitive market is characterized by<br>A)

Q291: In the short run, a perfectly competitive