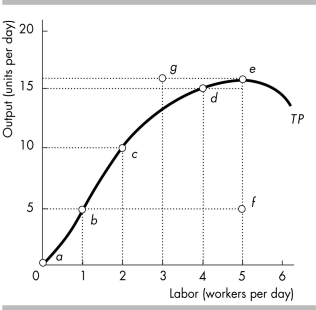

-In the above figure, the maximum number of units that 4 workers can produce is

Definitions:

FICA Social Security Tax

A United States federal tax required to be withheld from an employee's paycheck to fund the Social Security program, which provides benefits for retirees, the disabled, and children of deceased workers.

FICA Medicare Tax

A federal payroll tax that is part of FICA, specifically designated to fund the Medicare program, which provides health insurance to elderly and disabled Americans.

Unemployment Tax Rates

Unemployment tax rates are percentages that employers must pay to state and federal agencies, based on the number of their employees, to fund unemployment insurance benefits.

Payroll Taxes Expense

Taxes that an employer incurs based on the wages and salaries of employees, including social security, medicare, and unemployment taxes.

Q22: Based on the above table, what is

Q58: The above table shows the short-run total

Q65: A perfectly competitive firm's economic profit is

Q123: In the short run, a firm will<br>A)

Q136: Which of the following shifts the AVC

Q201: A cost that has already been made

Q265: The law of diminishing returns implies that,

Q319: Using the data in the above table,

Q382: The long run<br>A) means a long period

Q431: With a technological change that increases productivity,