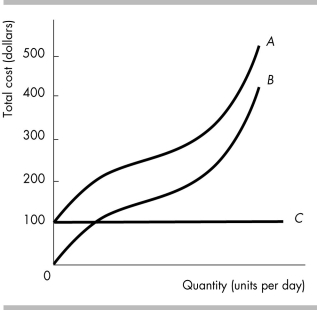

-In the above figure, the total variable cost curve is curve

Definitions:

Useful Life

The estimated period over which a fixed asset is expected to be usable by the entity, affecting its depreciation calculation.

Straight-Line Method

An accounting method of depreciating fixed assets evenly over their useful lives.

Depreciation Expense

Depreciation expense is the systematic allocation of the cost of a tangible asset over its useful life, reflecting the asset's consumption, wear and tear, or obsolescence.

Salvage Value

The estimated residual value of an asset at the end of its useful life, reflecting what it can be sold for or its scrap value.

Q8: Cindy's Sweaters' production function is shown in

Q66: In the long run, a perfectly competitive

Q71: Mr. Adams owns a textile business. In

Q116: You have just been named President and

Q125: The term "fixed cost" refers to the

Q210: Based on the production data for Pat's

Q233: The table above shows four methods for

Q311: A period of time in which the

Q386: Marginal cost refers to the increase in

Q415: Martha's Cleaning Services is a perfectly competitive