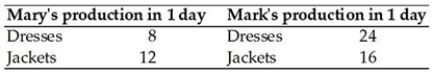

In the table above, how many jackets must Mary forgo for every dress she makes?

In the table above, how many jackets must Mary forgo for every dress she makes?

Definitions:

Tax Return

A document filed with a state or federal government detailing income earned and taxes owed for the year.

Self-Employment Taxes

Taxes that cover the Social Security and Medicare contributions for individuals who work for themselves.

AGI Deduction

A deduction from gross income to calculate Adjusted Gross Income (AGI), incorporating specific deductions like tuition fees or student loan interest.

Qualified Moving Expenses

Qualified Moving Expenses are those costs that are deductible when an individual relocates for employment reasons and meets certain distance and time tests defined by the IRS.

Q13: Explain how parenting is a relationship between

Q20: Suppose the natural unemployment rate is 5

Q24: If the MPC is 0.6 and there

Q27: In the long run, the unemployment rate<br>A)

Q39: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8401/.jpg" alt=" The figure above

Q45: In the figure above, what is the

Q55: The largest category of banks' assets is<br>A)

Q89: In the figure above, ceteris paribus, an

Q109: In an infant, brain development occurs in

Q218: One of the advantages of a longitudinal