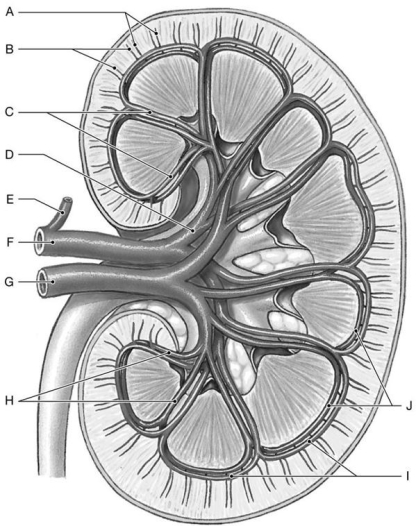

Figure 26.5

Identify the labeled structure(s) in each of the following questions.

-Identify the structure(s) indicated by Label H.

Definitions:

Temporary Differences

Differences between the accounting value and tax value of assets and liabilities, resulting in deferred tax assets or liabilities.

Deferred Income Taxes

Taxes that are assessed or paid on income that is recognized in one period for financial reporting purposes but in a different period for tax purposes.

Fair Value Increments

Increases in the value of an asset or security that result from a reassessment of its fair value, often reflected in financial statements to show current market conditions.

Deferred Tax Liability

A tax obligation that a company owes and will pay in the future, resulting from timing differences between the recognition of income and expenses for financial reporting and tax purposes.

Q4: A dental assistant's salary depends primarily on

Q17: What organization that represents the dental assisting

Q29: Which of the following is a function

Q40: When parents live separately,the child's personal information

Q43: Identify the structure indicated by Label M.<br>A)

Q45: Which of the following is the pouch

Q46: Ninety percent of nutrient absorption occurs in

Q80: Which cell population primarily functions in providing

Q100: Identify the structure(s) indicated by Label L.<br>A)

Q103: Identify the structure indicated by Label H.<br>A)