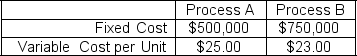

A company is evaluating which of two alternatives should be used to produce a product that will sell for $35.00 per unit. The following cost information describes the two alternatives:  The break-even volume for Process B is

The break-even volume for Process B is

Definitions:

Rib Area

The part of the body's torso that houses the rib cage, providing protection for the thoracic organs.

Blood Supply

The total volume of blood circulating within the body or provided to a particular organ or tissue.

Arterioles

Small branches of arteries that lead to capillaries, controlling blood flow and pressure via constriction and dilation.

Arteries

Blood vessels that carry oxygenated blood away from the heart to various parts of the body.

Q8: A company is considering producing an item

Q10: Variable (quantitative) control charts are used to

Q11: General as opposed to specific purpose equipment

Q18: The basic tools of process analysis include

Q34: List some non-economic factors that can influence

Q41: When probabilities are assigned to states of

Q58: Appraisal costs include the following except<br>A) inspection

Q73: List five ways by which the design

Q94: The most critical elements in the process

Q95: Using Table 9.1, the earliest start time