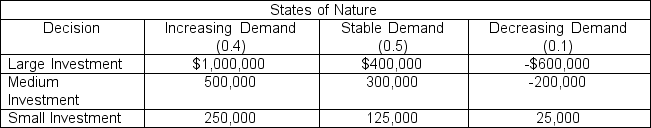

A family business is considering making an investment in its manufacturing operation. Three decisions are under consideration: (1) a large investment; (2) a medium investment; and (3) a small investment. The business believes that there are three possible future outcomes for its product: (1) increasing demand; (2) stable demand; and (3) decreasing demand. The business believes that the probability for increasing, stable and decreasing product demand are 0.4, 0.5, and 0.1, respectively. The following payoff table describes the decision situation:  The expected value of perfect information for the family business is

The expected value of perfect information for the family business is

Definitions:

Dying Patients

Individuals who are in the final stage of life, facing the process of death due to illness, injury, or age.

Terminally Ill

A condition in which a disease is incurable and irreversible, and it is expected to result in the death of the patient within a relatively short time period.

Opioid Medications

A class of drugs that include both illegal substances, like heroin, and prescribed pain relievers, used to treat moderate to severe pain by acting on opioid receptors in the brain.

Immobility

The state of being unable to move, often resulting from injury, disease, or a specific health condition.

Q4: Accounting equation <br>The total assets and total

Q5: A ? Adjustment for accrued revenues <br>At

Q6: Income statement; net loss <br>The following revenue

Q18: Errors in trial balance <br>The following preliminary

Q44: The European Union requires that strict quality

Q53: As process selection moves up the diagonal

Q55: Briefly discuss partnering.

Q59: The consumer makes the final judgment regarding

Q72: The maximum value of perfect information to

Q92: Choosing among a single-, double- and multiple-sampling