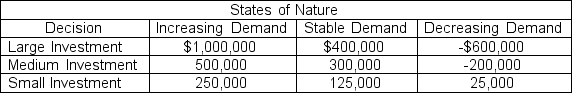

A family business is considering making an investment in its manufacturing operation. Three decisions are under consideration: (1) a large investment; (2) a medium investment; and (3) a small investment. The business believes that there are three possible future outcomes for its product: (1) increasing demand; (2) stable demand; and (3) decreasing demand. The following payoff table describes the decision situation:  The best decision for the business using the equal likelihood criterion would be to

The best decision for the business using the equal likelihood criterion would be to

Definitions:

Option Value

The premium or price for holding an option, representing the potential benefit of choosing one course of action over another.

Convertible Bond

An investment vehicle that offers the ability to be exchanged for a set portion of the company's shares at predefined periods within its term, usually upon the bondholder's initiative.

Call's Value

The intrinsic value of a call option, reflecting the difference between the underlying asset's price and the strike price of the option, if positive.

Exercise Price

The price at which the holder of an option can buy (call) or sell (put) the underlying asset or security.

Q2: Adjusting entries <br>Selected account balances before adjustment

Q3: Adjustments and financial statements <br>Several years ago,

Q4: Ledger accounts, adjusting entries, financial statements, and

Q5: Briefly discuss the difference between (a) a

Q6: How are waiting line costs and service

Q45: What is decision analysis?

Q53: Use waiting line analysis to improve service.

Q71: A transformation process is a series of

Q81: Describe what the operations function is and

Q82: A service blueprint contains which of the