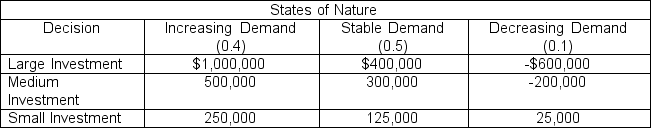

A family business is considering making an investment in its manufacturing operation. Three decisions are under consideration: (1) a large investment; (2) a medium investment; and (3) a small investment. The business believes that there are three possible future outcomes for its product: (1) increasing demand; (2) stable demand; and (3) decreasing demand. The business believes that the probability for increasing, stable and decreasing product demand are 0.4, 0.5, and 0.1, respectively. The following payoff table describes the decision situation:  The expected value for the large investment decision is

The expected value for the large investment decision is

Definitions:

Bond Exchange

The process of trading bonds in the financial markets or swapping one bond for another to achieve better investment goals.

Carrying Cost

The total cost associated with holding inventory, including storage, insurance, taxes, depreciation, and opportunity costs, among others.

Setup Cost

The expenses incurred in preparing equipment or processes for manufacturing an order or batch of products.

Annual Demand

The total quantity of a product or service that consumers are willing and able to purchase over a year.

Q1: Ethics in Action <br>Colleen Fernandez, president of

Q3: Financial statements <br>Seth Feye established Reliance Financial

Q5: The constant average values of operating characteristics

Q10: Which of the following is not a

Q18: Sales tax transactions <br>Journalize the entries to

Q23: Horizontal analysis of income statement <br>The following

Q28: A small parts manufacturer has just engineered

Q38: Cost of merchandise sold <br>Identify the errors

Q52: The allowable range of the variation in

Q118: What is a p-chart and when is