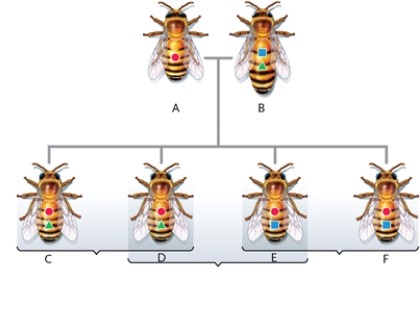

Figure 32-4

-In Figure 32-4, why do bees C and D differ from bees E and F?

Definitions:

Beta

A measure of a stock's volatility in relation to the overall market, indicating the level of risk associated with a particular investment.

Market Risk

The risk of losses in financial markets due to factors such as economic recessions, political turmoil, or changes in interest rates, affecting the overall market.

Asset Allocation

The strategy of distributing investments among various asset classes, such as stocks, bonds, and cash, to achieve a desired risk-reward balance.

Stock Selection

The process of choosing stocks for investment based on criteria such as financial health, market position, and growth potential to maximize returns.

Q1: In the experiment involving bluegill sunfish and

Q6: tertiary consumers

Q33: age-specific fecundity<br>A)population increasing steadily by a constant

Q38: Describe several ways that fruits can aid

Q48: Mutualistic relationships between animal species are common.

Q51: Female blackbirds choose a mate primarily by

Q51: Some fully differentiated plant cells are totipotent.

Q53: Which plant hormones appear to regulate the

Q69: Which term best describes the movement of

Q84: The presence of which hormone results in