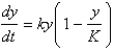

The Pacific halibut fishery has been modeled by the differential equation  where

where  is the biomass (the total mass of the members of the population) in kilograms at time t (measured in years), the carrying capacity is estimated to be

is the biomass (the total mass of the members of the population) in kilograms at time t (measured in years), the carrying capacity is estimated to be  and

and  per year. If

per year. If  , find the biomass a year later.

, find the biomass a year later.

Definitions:

Taxable Income

The amount of income that is used to determine how much tax an individual or a business owes to the government.

Form 1040EZ

was a simplified tax form used by individuals with straightforward tax situations, now replaced by Form 1040.

Deduction

An expense that can be subtracted from taxable income, reducing the total amount of tax owed.

Single Taxpayer

A filing status for individuals who are unmarried and do not qualify for any other filing status on their tax returns.

Q1: An open rectangular box with volume <img

Q3: Mr Parker is a 68-year-old retired construction

Q5: Two species may coexist indefinitely in some

Q10: Is this statement true or false: Thirst

Q24: Let a and b be real numbers.

Q39: Which food is an example of a

Q57: The most common nutrient deficiency in young

Q64: Find the area of the surface obtained

Q68: Write an inequality to describe the half-space

Q70: Suppose that over a certain region of