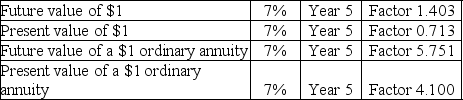

Use the data in table 3.1 to answer the following question(s) :

Table 3.1

Table 3.1

-Refer to Table 3.1 above. How much will you need to deposit today to enable you to withdraw $1,000 each year for the next 5 years if the money is invested at 7%?

Definitions:

Income Taxes Payable

This account reflects the amount of income taxes a company owes to the government but has not yet paid, representing a liability on the balance sheet.

Income Tax Expense

The cost incurred by businesses or individuals due to earnings, calculated according to government tax rates and laws.

Pretax Financial Income

The income of a company before taxes have been deducted, commonly used in the context of reporting and financial analysis.

Permanent Difference

A difference between the book income and taxable income that will not reverse over time.

Q24: An increase in borrowing by the U.S.

Q37: Obtaining an annual credit report is free

Q47: Liquidity is necessary because there are times

Q50: The item that receives the most weight

Q62: One of Sergeant Hernandez's rookie officers has

Q63: Which cash inflow is more likely to

Q79: The efforts of the child savers culminated

Q89: Interest expense paid on both home loans

Q106: Cash inflow can be increased by all

Q109: Which of the following characteristics is common