Use the following to answer questions

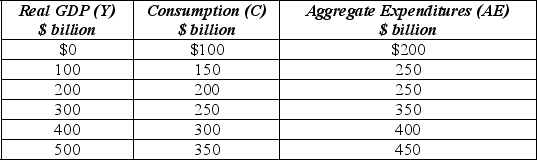

Exhibit: Aggregate Expenditures (AE)

in a Simplified Economy

-(Exhibit: Aggregate Expenditures (AE)

In a Simplified Economy)

Consider a simple economy that is made up of only two sectors, households and firms, and that investment is autonomous.Further, disposable personal income = real GDP.Suppose that actual real GDP in this economy is $500 billion in a particular period.We would expect to see

Definitions:

State Unemployment Tax Rate

The rate at which employers are taxed by their state government to fund unemployment insurance benefits for laid-off workers.

Federal Unemployment Tax Rate

The percentage rate at which employers are taxed by the federal government to fund the unemployment benefits pool.

FICA Tax Rates

The percentage rates set by law that determine the amount of Social Security and Medicare taxes that must be withheld from employees' paychecks and matched by employers.

Employer's Taxes

Taxes that employers are required to pay on behalf of their employees, such as social security and Medicare taxes in the United States.

Q2: The relationship between aggregate expenditures and real

Q22: A contractionary fiscal policy shifts the aggregate

Q27: The Fed increases the money supply by

Q98: (Exhibit: The Bond Market)<br>Suppose the Fed takes

Q107: (Exhibit: Aggregate Expenditures and Real GDP 2)<br>Let

Q118: In the long run, the major cause

Q125: If the economy experiences an inflationary gap,

Q136: (Exhibit: Supply-Side Economics)<br>If the economy's long-run aggregate

Q172: As a result of the financial crisis

Q209: (Exhibit: Income and Consumption)<br>When disposable personal income