Use the following to answer questions .

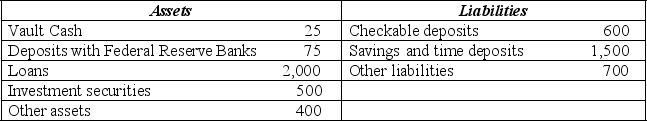

Exhibit: Balance Sheet of the Alpha-Beta Bank

-(Exhibit: Balance Sheet of the Alpha-Beta Bank) If the required reserve ratio is 10% and the market interest rate is 6%, then the opportunity cost of holding excess reserves is

Definitions:

American Call Option

An option contract that gives the holder the right, but not the obligation, to buy a security at a specified price before the option expires.

Expiration Date

The specified date on which an options or futures contract becomes null and void.

ESOs

Employee Stock Options refer to the rights given to employees, included in their remuneration package, enabling them to buy shares of the company stock at a predetermined price.

Guarantee

A formal promise or assurance, typically in writing, that certain conditions will be fulfilled or that a product will meet a specified level of quality.

Q11: Which of the following items would NOT

Q38: Towards the end of the twentieth century,

Q53: A contractionary fiscal policy will reduce a

Q82: Which of the following best explains why

Q85: (Exhibit: Changes in the Money Supply)<br>Following the

Q86: Suppose the economy is initially in long-run

Q89: The demand for money is negatively related

Q91: (Exhibit: Long-run Equilibrium)<br>Based on the figure, we

Q145: The price of a bond is determined

Q210: Gresham's Law<br>A)deals with the theory of regulatory