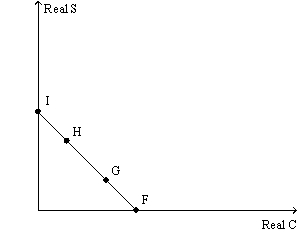

Figure 7.1

-In Figure 7.1 if the household moves from point G to point H on its budget, it would be:

Definitions:

401k Plan

A retirement savings plan sponsored by an employer allowing employees to save and invest a portion of their paycheck before taxes are taken out.

Payroll Taxes

Taxes that are taken out of employee's paychecks by the employer, including federal and state income taxes and Social Security and Medicare taxes.

Employer Liability

Refers to an employer's legal responsibility for the harms caused by their employees or agents while they are performing duties within the scope of their employment.

Incurred

Refers to costs, expenses, or liabilities that have been realized or obtained by a business, usually through its operations.

Q1: An example of a non-rival good is:<br>A)an

Q7: With a temporary change in government purchases

Q9: Which of the following is not an

Q19: The fastest growing part of the Eurozone

Q36: The biggest category of state and local

Q48: The government budget constraint without borrowing is:<br>A)G<sub>t</sub>

Q49: Money is different from other assets like

Q54: The growth accounting formula is:<br>A) <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8790/.jpg"

Q56: In the IS-LM model as the taxes

Q58: According to the IS-LM model, how shall