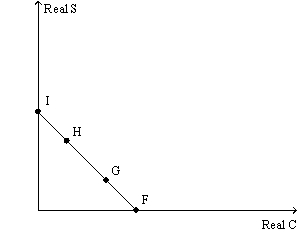

Figure 7.1

-In Figure 7.1 if the household moves from point I to point H on its budget, it would be:

Definitions:

Fair Value

The sum fetched from the sale of an asset or spent on the transition of a liability in a smooth transaction involving market participants at the time of assessment.

Foreign Currency Nonmonetary Assets

Assets that are not in cash and are not expected to be converted into cash in the near future, valued in a currency other than the entity's functional currency.

Historic Rate

The exchange rate at which a transaction was executed in the past, used for recording foreign currency transactions in financial statements.

Non-Free-Standing Subsidiaries

Entities that are significantly controlled or wholly owned by another firm but lack the independent structure or operations typically associated with subsidiary companies.

Q4: Growth accounting shows that economic growth depends

Q7: The rewards to private R&D depend on:<br>A)the

Q9: When the marginal product of labour increases

Q14: In Figure 10.1, if the money supply

Q31: According to the IS-MP-PC model, a lower

Q39: A reason that nominal wages might be

Q49: If the labour force is 100 million,

Q52: If the inflation rate is 3% and

Q57: The model predicts that in a recession

Q60: Real income is:<br>A)wL + i(B+K)<br>B)(w/P)L + i((B/P)+