The Tearess Company can accept either Proposal A or Proposal B (but not both), or it can reject both investment proposals. Proposal A requires an investment of $7000 and promises increased net cash inflows of $2600 for five years. Proposal B requires an investment of $7000 and promises increased net cash inflows of $3000 in each of the first three years, $2000 in the fourth year and $2200 in the fifth year. The company's minimum acceptable rate of return is 20%.

Prepare an analysis to determine which (if either) of the proposals should be selected for investment.

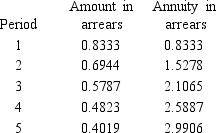

Discount factors for 20%:

Definitions:

Firm's Output

The total quantity of goods or services produced by a company within a specific period.

Short Run

Refers to a time period in which at least one input (e.g., capital) is fixed, limiting the ability of a business to adjust to changes in market demand or production costs.

Firm's Output

The total quantity of goods or services produced by a company.

Break-Even Point

The juncture where a business's total expenses match its total income, resulting in neither a profit nor a loss.

Q1: Find an example of vertical integration within

Q5: Distinguish clearly between mass marketing and target

Q6: Distinguish between leader pricing and bait pricing.

Q12: The Marketing Plan Coach software on the

Q15: If fixed costs for a company are

Q18: Distinguish between an attractive opportunity and a

Q19: Responsibility accounting is where an entity is

Q23: Is it unfair to criticize a competitor's

Q50: Do you think Toyota should convert all

Q75: Comparability, as a qualitative characteristic of useful