The operating net profit before income tax of Fraxinus Ltd for the year ended 30 June - the entity's first year of operation - was $8 000 000. The figure was derived using the accrual approach to measuring profit. The company determines tax based on a cash basis.

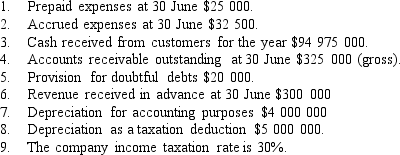

Additional information

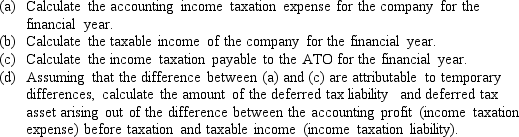

Taking into consideration the additional information provided above, you are required to:

Taking into consideration the additional information provided above, you are required to:

Definitions:

Average Revenue

The amount of money a firm earns per unit of output sold, calculated by dividing total revenue by the quantity sold.

Marginal Cost

The increase or decrease in the total cost that arises when the quantity produced is incremented by one unit.

Average Total Cost

The total cost of production (fixed and variable costs combined) divided by the total quantity produced.

Total Revenue

The overall income obtained by an enterprise from its sales or services within a designated period.

Q1: To be useful to management, accounting information

Q18: The relevant range of activity relates to

Q19: The following information is given for Ollufsen

Q26: Strategic planning differs from operational planning in

Q28: Hilde Company reported accounts receivable of $40

Q30: Jack and Jill Repairers is founded by

Q32: Which of the following factors under management's

Q45: If an investor (shareholder) discovers by analysing

Q47: Which of the following would not explain

Q56: Which of the following is an investing