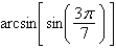

Use the properties of inverse trigonometric functions to evaluate  .

.

Definitions:

Sensory Decay

The decline in the ability of a sensory system to detect or accurately interpret information over time or due to external factors.

Retrograde Amnesia

A loss of memory for experiences that occurred shortly before a loss of consciousness.

State-Dependent Memory

The phenomenon where information learned in a particular state of mind is more easily recalled when in that same state.

Repulsed Feeling

An intense feeling of disgust or aversion towards something or someone.

Q8: Perform the operation shown below and leave

Q36: Represent the complex number below graphically. <img

Q47: Find the angle between the vectors u

Q50: Find all the real zeros of <img

Q53: Evaluate the logarithm <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8633/.jpg" alt="Evaluate the

Q68: Find the exact value of <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8633/.jpg"

Q71: Graph the function <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8633/.jpg" alt="Graph the

Q95: Find a polynomial with the given zeros.

Q116: Simplify the expression. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8633/.jpg" alt="Simplify the

Q139: Graph the function <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8633/.jpg" alt="Graph the