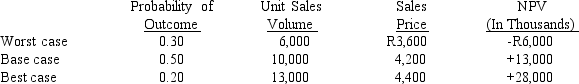

Klott Company encounters significant uncertainty with its sales volume and price in its primary product.The firm uses scenario analysis in order to determine an expected NPV, which it then uses in its budget.The base case, best case, and worst case scenarios and probabilities are provided in the table below.What is Klott's expected NPV, standard deviation of NPV, and coefficient of variation of NPV?

Definitions:

Out-Of-The-Money Call

Refers to a call option where the strike price is higher than the market price of the underlying asset.

Treynor-Black Model

A portfolio optimization model that blends active and passive investments to optimize risk-adjusted returns.

Alpha Coefficient

A measure of the performance on a risk-adjusted basis, identifying the excess return of an investment relative to the return of a benchmark index.

Q9: As a general rule, the capital structure

Q22: The residual dividend policy implies that investors

Q24: The average length of time required to

Q31: A high current ratio insures that a

Q34: Generally speaking, companies in Italy and Japan

Q37: Any capital budgeting investment rule should depend

Q56: In the text, the "red-line method" refers

Q64: The probability of incurring bankruptcy increase as

Q65: The marginal cost of capital _ as

Q92: The primary function of the capital budget