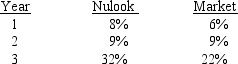

Below are the returns of Nulook Cosmetics and the "market" over a three-year period:  Nulook finances internally using only retained earnings, and it uses the Capital Asset Pricing Model with a historical beta to determine its required rate of return.Currently, the risk-free rate is 7 percent, and the estimated market risk premium is 6 percent.Nulook is evaluating a project which has a cost today of R2,028 and will provide estimated cash inflows of R1,000 at the end of the next 3 years.What is this project's MIRR?

Nulook finances internally using only retained earnings, and it uses the Capital Asset Pricing Model with a historical beta to determine its required rate of return.Currently, the risk-free rate is 7 percent, and the estimated market risk premium is 6 percent.Nulook is evaluating a project which has a cost today of R2,028 and will provide estimated cash inflows of R1,000 at the end of the next 3 years.What is this project's MIRR?

Definitions:

Adjusting Entry

An accounting transaction recorded to correct or update the financial statements prior to the issuance of the financial statements.

Liabilities

Financial obligations or debts that a company owes to others, often categorized as current or long-term.

Stockholders' Equity

This represents the ownership interest of shareholders in a corporation, calculated as the company's total assets minus its total liabilities.

Net Income

The total profit of a company after all expenses, taxes, and costs have been subtracted from total revenue.

Q9: Which of the following statements is correct?<br>A)

Q14: In capital budgeting analyses, it is possible

Q17: Suppose two firms with the same amount

Q18: The fact that no explicit interest cost

Q24: The component costs of capital are market-determined

Q26: Refer to Copybold Corporation.What is the coefficient

Q28: If your firm's DSO or aging schedule

Q41: A firm is evaluating a new machine

Q42: Because of differences in the expected returns

Q75: Given the following information, calculate the NPV