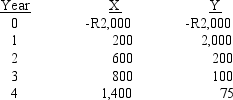

Your company is considering two mutually exclusive projects, X and Y, whose costs and cash flows are shown below:  The projects are equally risky, and the firm's required rate of return is 12 percent.You must make a recommendation, and you must base it on the modified IRR.What is the MIRR of the better project?

The projects are equally risky, and the firm's required rate of return is 12 percent.You must make a recommendation, and you must base it on the modified IRR.What is the MIRR of the better project?

Definitions:

Not-for-profit Organization

A type of organization that does not distribute its excess profits to owners or shareholders but instead uses them to help achieve its goals.

Capital Fund

A fund created for the purpose of undertaking capital projects or investing in long-term assets, funded by capital expenditures or external financing sources.

General Fund

The primary operating fund of a government, covering general operations and services not accounted for in special-purpose funds.

Direct Increase

A rise in the value or quantity of something without intervening steps or intermediaries.

Q6: The change in net working capital associated

Q8: The firm's cost of external equity capital

Q13: The NPV method implicitly assumes that the

Q16: If a firm cannot invest retained earnings

Q31: If you buy a bond that is

Q66: Which of the following are generally considered

Q67: Tech Engineering Company is considering the purchase

Q77: Which of the following statements is correct?<br>A)

Q86: In general, it is not possible for

Q88: Project A has a cost of R1,000,