CAPM Analysis

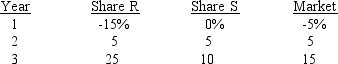

You have been asked to use a CAPM analysis to choose between shares R and S, with your choice being the one whose expected rate of return exceeds its required rate of by the widest margin.The risk-free rate is 6%, and the required return on an average share (or "the market") is 10%.Your security analyst tells you that Share S's expected rate of return is = 11%, while Share R's expected rate of return in = 13%.The CAPM is assumed to be a valid method for selecting shares, but the expected return for any given investor (such as you) can differ from the required rate of return for a given share.The following past rates of return are to be used to calculate the two shares' beta coefficients, which are then to be used to determine the shares' required rates of return.

-Refer to CAPM Analysis.Calculate both shares' betas.What is the difference between the betas, i.e., what is the value of betaR - betaS? (Hint: The graphical method of calculating the rise over run, or (Y2 - Y1) divided by (X2 - X1) may aid you.)

Definitions:

Lack of Parallelism

A stylistic or grammatical flaw where elements in a sentence or list do not maintain a consistent structure or pattern.

Hedging

The use of cautious language to make statements less absolute, often for the purpose of reducing risk or uncertainty.

Readability

The ease with which text can be read and understood by the target audience, often influenced by factors such as language, structure, and design.

Instruction Manual

A document that provides guidelines, procedures, or directions for using a product or completing a task.

Q2: Business risk is concerned with the operations

Q4: The longer the maturity of a bond,

Q23: A bank pays a quoted annual (simple)

Q31: Refer to Rollins Corporation.What is Rollins' cost

Q44: You are considering an investment in a

Q47: Which of the following statements is correct?<br>A)

Q50: If expectations for long-term inflation rose, but

Q53: If we include the cost of bankruptcy

Q54: If a project is small relative to

Q68: Your company is planning to borrow R1,000,000