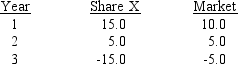

Share X and the "market" had the following returns during the last three years, and the same relative volatility is expected to exist in the future:  The riskless rate is rRF = 8%, and the expected return on the market is 12 percent.If equilibrium exists, what is the expected return on Share X?

The riskless rate is rRF = 8%, and the expected return on the market is 12 percent.If equilibrium exists, what is the expected return on Share X?

Definitions:

Golden Rule

A moral or ethical principle that suggests treating others as one would wish to be treated themselves, often emphasized in various religious and philosophical traditions.

Inverted Pyramid

A method of writing used in news articles where information is presented in descending order of importance.

Op-Eds

Opinion pieces that usually concern current issues.

White Papers

Detailed reports or guides designed to educate or persuade stakeholders about a particular issue, solution, or product, often used in marketing and policy discussions.

Q9: The difference between the PV of an

Q10: Houston Inc.is considering a project which involves

Q10: If you are considering purchasing a share

Q30: Bonds with higher liquidity will demand higher

Q38: Bouchard Company's shares sell for R20 per

Q49: You have a chance to purchase a

Q52: If an investment project would make use

Q65: One advantage of the payback period method

Q77: Which of the following ratings by Moody's

Q98: North West Mining is evaluating the introduction