CAPM Analysis

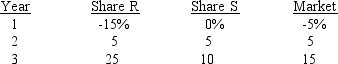

You have been asked to use a CAPM analysis to choose between shares R and S, with your choice being the one whose expected rate of return exceeds its required rate of by the widest margin.The risk-free rate is 6%, and the required return on an average share (or "the market") is 10%.Your security analyst tells you that Share S's expected rate of return is = 11%, while Share R's expected rate of return in = 13%.The CAPM is assumed to be a valid method for selecting shares, but the expected return for any given investor (such as you) can differ from the required rate of return for a given share.The following past rates of return are to be used to calculate the two shares' beta coefficients, which are then to be used to determine the shares' required rates of return.

-Refer to CAPM Analysis.Calculate both shares' betas.What is the difference between the betas, i.e., what is the value of betaR - betaS? (Hint: The graphical method of calculating the rise over run, or (Y2 - Y1) divided by (X2 - X1) may aid you.)

Definitions:

Heteronomous

Subject to rules, laws, or an authority external to oneself.

Card Game

A game played using a deck or pack of playing cards as the primary device with which the game is played.

Autonomous

Referring to the capability of functioning independently or having self-governance.

Immanent

Existing or operating within; inherent within the physical world or the universe.

Q6: The central result from the work of

Q13: A bond with a R100 annual interest

Q17: Which of the following statements is most

Q19: The current ratio and inventory turnover ratio

Q33: As the capital budgeting director for Chapel

Q42: The steeper the demand curve for a

Q45: A college intern working at Anderson Paints

Q47: You have just purchased a life insurance

Q61: Sipho just signed a long-term lease on

Q84: Suppose a firm is considering production of