CAPM Analysis

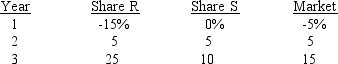

You have been asked to use a CAPM analysis to choose between shares R and S, with your choice being the one whose expected rate of return exceeds its required rate of by the widest margin.The risk-free rate is 6%, and the required return on an average share (or "the market") is 10%.Your security analyst tells you that Share S's expected rate of return is = 11%, while Share R's expected rate of return in = 13%.The CAPM is assumed to be a valid method for selecting shares, but the expected return for any given investor (such as you) can differ from the required rate of return for a given share.The following past rates of return are to be used to calculate the two shares' beta coefficients, which are then to be used to determine the shares' required rates of return.

-Refer to CAPM Analysis.Set up the SML equation and use it to calculate both shares' required rates of return, and compare those required returns with the expected returns given above.You should invest in the share whose expected return exceeds its required return by the widest margin.What is the widest margin, or greatest excess return r-r?

Definitions:

Reasonable Care

The degree of caution and concern an ordinarily prudent and rational person would use in similar circumstances.

Conditional Privilege

A special right, immunity, permission, or benefit given to certain individuals that allows them to make any statements about someone without being held liable for defamation for any false statement made without actual malice.

Defamation

A wrongful act of communicating false statements about a person that injure the person's reputation or good name.

Actual Malice

In defamation, either a person's knowledge that his or her statement or published material is false or the person's reckless disregard for whether it is false.

Q9: A publicly owned corporation is simply a

Q24: Which of the following is not a

Q38: Sensitivity analysis is a risk analysis technique

Q39: The cost of debt, rd, is always

Q39: If the tax laws stated that R0.50

Q57: The Coffee Corporation has been presented with

Q57: Refer to Rollins Corporation.What is Rollins' WACC

Q59: Assume that a new law is passed

Q60: The correct discount rate for a firm

Q64: Chauke Company had the following partial statement