CAPM Analysis

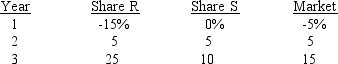

You have been asked to use a CAPM analysis to choose between shares R and S, with your choice being the one whose expected rate of return exceeds its required rate of by the widest margin.The risk-free rate is 6%, and the required return on an average share (or "the market") is 10%.Your security analyst tells you that Share S's expected rate of return is = 11%, while Share R's expected rate of return in = 13%.The CAPM is assumed to be a valid method for selecting shares, but the expected return for any given investor (such as you) can differ from the required rate of return for a given share.The following past rates of return are to be used to calculate the two shares' beta coefficients, which are then to be used to determine the shares' required rates of return.

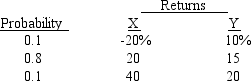

-Here are the expected returns on two shares:  If you form a 50-50 portfolio of the two shares, what is the portfolio's standard deviation?

If you form a 50-50 portfolio of the two shares, what is the portfolio's standard deviation?

Definitions:

Career Changes

The act of moving from one profession or occupational field to another.

Anxiety Attacks

Sudden episodes of intense fear or panic, often accompanied by physical symptoms such as heart palpitations and dizziness.

Temperamental Shyness

An innate personality trait characterized by feelings of nervousness or timidity in new situations or when interacting with new people.

Personality Traits

Characteristics that predict consistent patterns of behavior, thought, and emotional responses in individuals.

Q14: Firms following a constant dividend ration payout

Q24: The average length of time required to

Q28: When a corporation wants to raise funds

Q31: Your company is considering a machine which

Q32: All other things constant, an increase in

Q47: The current price of a 10-year, R1,000

Q57: Alumbat Corporation has R800,000 of debt outstanding,

Q66: The coupon rate is the rate of

Q69: Tuna Inc., a large tuna canning firm

Q90: Which of the following is not discussed