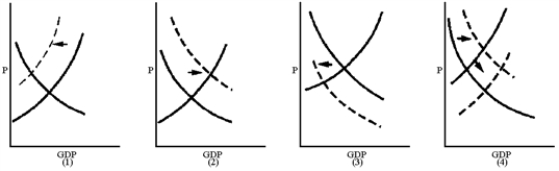

Figure 11-2

-Which graph in Figure 11-2 best reflects a Keynesian's view of the impact of raising taxes on saving?

Definitions:

Tax

A tax represents an obligatory monetary fee or different kind of charge applied to a taxpayer by a government entity, intended to finance government operations and a range of public spending.

Sellers Receive

Refers to the revenue or payment that sellers get in exchange for providing goods or services in a market.

Tax

Mandatory financial contributions imposed by a government on individuals, corporations, or goods to fund public expenditures.

Q15: In Figure 10-6, which graph best illustrates

Q39: Which of the following was a result

Q39: An increase in the reserve requirement<br>A)increases the

Q52: When people trade goods for money, money

Q120: If money wages increase, the most likely

Q122: If Congress votes to increase government purchases

Q151: If consumers receive an increase in income

Q162: Wages are the major element of cost

Q181: The FDIC<br>A)insures most bank deposits for up

Q184: Income tax acts as a shock absorber