Figure 10-9

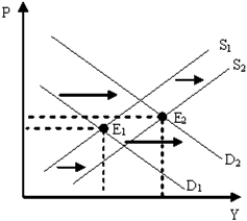

-Figure 10-9 describes which of the following periods in the United States?

Definitions:

Straight-line Basis

A method of calculating depreciation of an asset, which evenly spreads the cost over its useful life.

Operating Income

Earnings before interest and taxes (EBIT), which shows a company's profit from its core business operations.

Tax Payments

Tax Payments are the compulsory financial charges or levies paid to the government by individuals, businesses, or other legal entities to fund public expenditures.

Non-operating Income

Non-operating Income is the income earned from non-core business activities, including one-time events or earnings from investments, that does not derive from the company's primary business operations.

Q5: Assume that the federal government wishes to

Q5: If people begin to hold more cash,

Q56: Productivity increases, brought about by increased education

Q144: Systemic risks are most likely to exist

Q170: Why does a tax change affect aggregate

Q173: One difficulty of computing the value of

Q183: If a "liberal" wanted to decrease aggregate

Q187: An increase in the price level causes

Q189: If the price level decreases, what will

Q209: Every Christmas, you buy yourself a lottery