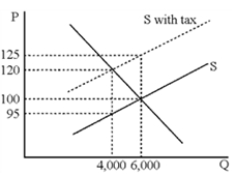

Figure 18-2

-Figure 18-2 shows the widget market before and after an excise tax is imposed.What percentage of the tax per widget is borne by consumers, considering the true economic incidence of the tax?

Definitions:

Bankruptcy

A legal proceeding involving a person or business that is unable to repay their outstanding debts, leading to the distribution of assets to creditors.

Preferred Stock

A category of corporate ownership that holds a superior claim over the company's resources and profits compared to common stocks, typically offering consistent dividend payments.

Equity

The ownership interest of shareholders in a corporation, represented by their shares of stock.

Dividends

Payments made by a corporation to its shareholder members, often derived from profits.

Q13: The distribution of income in a market

Q15: A market will be efficient even if

Q83: Many economists believe a comprehensive income tax<br>A)would

Q117: Which of the following is not true?<br>A)George

Q120: Centrally planned economies are able to cope

Q129: Which of the following is most consistent

Q130: Increasing concentration always means an industry has

Q138: The most threatening and damaging detrimental externality

Q145: What are the advantages of a tax

Q183: Which of the following is an example