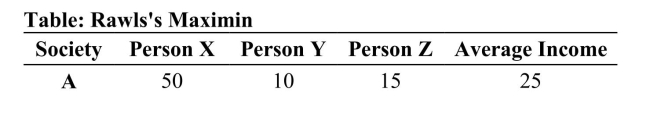

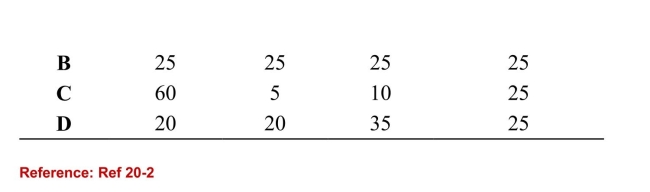

(Table: Rawls's Maximin) Refer to the table. According to themaximin principle, which of the societies is ranked lowest?

(Table: Rawls's Maximin) Refer to the table. According to themaximin principle, which of the societies is ranked lowest?

Definitions:

Excise Taxes

Taxes imposed on specific goods, services, or activities, often used to discourage consumption of certain items or to raise revenue for targeted purposes.

Consumption Taxes

Taxes imposed on spending on goods and services, such as sales tax or Value Added Tax (VAT).

Average Tax Rate

The percentage of gross income that goes towards tax payments, determined by dividing the sum of taxes paid by the gross income.

Taxable Income

The amount of income used to calculate how much the government can tax an individual or a corporation.

Q12: Although trade increases productivity, it decreases society'scollective

Q24: Schools are rewarded for how well their

Q37: Suppose that the equilibrium price in the

Q54: The question of whether selling kidneys is

Q65: Suppose a U.S. presidential candidate announced thathe

Q72: Which of the following examples specifies the

Q92: The median voter theorem holds that the:<br>A)policy

Q100: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1027/.jpg" alt=" (Table: Production in

Q144: A risky portfolio is one that:<br>I. is

Q194: Corporate culture helps firms incentivize what is