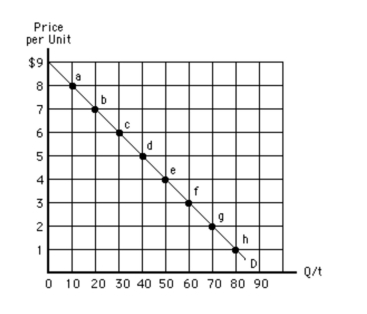

Exhibit 57  Which of the following is true between points g and h in Exhibit 57?

Which of the following is true between points g and h in Exhibit 57?

Definitions:

Risk-Free Rate

The risk-free rate is the theoretical return on an investment with zero risk, serving as a benchmark for measuring investment performance.

Market Risk Premium

The additional return an investor expects from holding a risky market portfolio instead of risk-free assets, critical for assessing investment risk.

Risk-Free Rate

The risk-free rate is the theoretical return on investment with no risk of financial loss, often represented by the yield on government securities.

Market Rate

The interest rate prevailing in the money market where instruments such as treasury bills and commercial paper are bought and sold.

Q25: A young chef is considering opening his

Q29: The law of diminishing marginal utility states

Q35: Suppose Lorna will buy more sweaters if

Q39: The merchandise trade balance measures<br>A)the value of

Q69: Demand curves usually slope downward because of

Q81: Other things equal, the supply of index

Q88: Usually the poorest fifth of the population

Q101: Which of the following is an example

Q118: Tradeable allowances:<br>A)are typically hard to pass through

Q154: Which component of U.S.household spending has grown