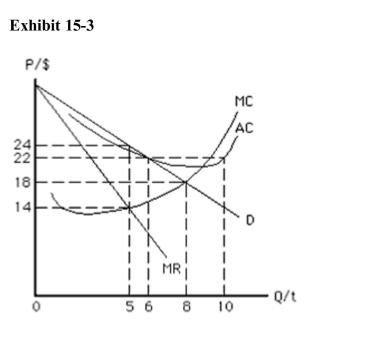

If regulators set price equal to marginal cost for the natural monopoly inExhibit 153, then from the usual profitmaximizing position, price changesfrom

If regulators set price equal to marginal cost for the natural monopoly inExhibit 153, then from the usual profitmaximizing position, price changesfrom

Definitions:

Personal Tax Rate

The percentage of one's income that is paid to the government in taxes, which varies based on income level and jurisdiction.

Corporate Tax Rate

The tax imposed on the net income of a corporation, with rates varying by country and sometimes also by the level of income.

Leverage

Leverage refers to the use of borrowing (debt in capital structure) to amplify potential returns from an investment or project.

Personal Tax Rate

The percentage at which an individual's income is taxed by the government, varying by income level and jurisdiction.

Q6: Why might two presidential candidates appear to

Q8: The more complicated the process used to

Q11: ) <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4910/.jpg" alt=") In

Q18: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4910/.jpg" alt=" In Exhibit 193,

Q23: The demand curve facing a firm will

Q36: If the government wishes to provide a

Q36: An extra hour of market work is

Q56: The exchange rate is the<br>A)ratio of exports

Q58: As the price paid to a resource

Q72: By itself, the substitution effect of an