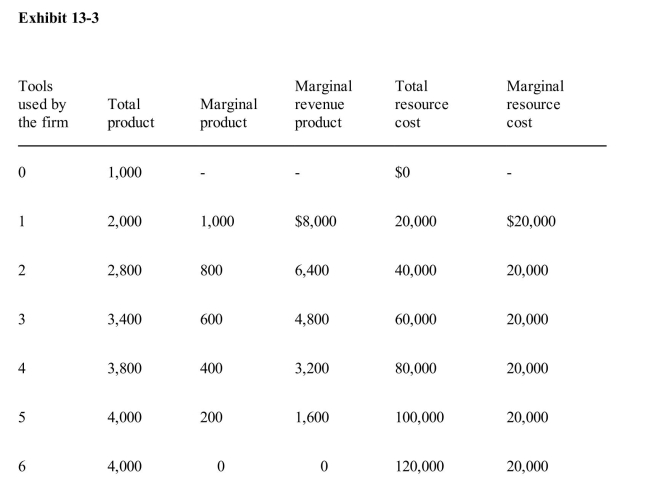

Exhibit 133 gives data on the number of tools a certain firm buys to use in its productionprocess.Assume that the tools are expected to last indefinitely, that operating expenses arenegligible, and that the price of the firm's output is expected to remain constant in the future.At an interest rate of 10 percent, the firm in Exhibit 133 should select

Exhibit 133 gives data on the number of tools a certain firm buys to use in its productionprocess.Assume that the tools are expected to last indefinitely, that operating expenses arenegligible, and that the price of the firm's output is expected to remain constant in the future.At an interest rate of 10 percent, the firm in Exhibit 133 should select

Definitions:

Risk-Free Asset

A Risk-Free Asset is an investment that theoretically guarantees its return and has no variance in its expected payout, typically government-issued securities.

Asset Beta

A measure of the risk of an asset isolated from the firm's financial risk, particularly useful in capital asset pricing models (CAPM).

Risk-Free Asset

An investment with a guaranteed return, without any risk of financial loss.

Positive Rate

An interest rate or yield that is above zero, reflecting a positive return on investment.

Q15: Which of the following does not reflect

Q23: One result of asymmetric information in the

Q48: Taxpayers and consumers end up paying for

Q48: Which of the following is an example

Q53: Scarcity is best defined as<br>A)unlimited resources<br>B)a shortage

Q55: Data on the U.S.income distribution suggest that<br>A)blackwhite

Q76: According to Coase, the optimal allocation of

Q81: Eligibility for income assistance benefits requires a

Q97: The major social insurance program in the

Q160: A monopoly firm will sell _output and