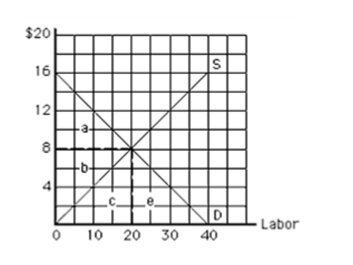

Exhibit 111  In Exhibit 111, the twentieth unit of the resource is earning a wage of

In Exhibit 111, the twentieth unit of the resource is earning a wage of

Definitions:

State Unemployment Taxes

Taxes imposed by state governments on businesses based on the amount of wages paid to employees, used to fund unemployment compensation benefits for workers who have lost their jobs.

Withholding Allowances

Claims made on a W-4 form that determine the amount of an employee’s income not subject to federal income tax withholding.

Percentage Method

A way to calculate taxes or other financial figures by applying a specific percentage rate to a base amount.

Federal Income Tax

An annual financial obligation enforced by the IRS on earnings of persons, businesses, trusts, and other legal entities.

Q7: SCENARIO: A MONOPOLIST<br>A monopolist faces a demand

Q10: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4910/.jpg" alt=" In Exhibit 111,

Q22: Which of the following countries has more

Q23: The associationcausation fallacy is the error of

Q27: Which of the following would reduce the

Q43: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4910/.jpg" alt=" In Exhibit 101,

Q44: Specialinterest legislation usually<br>A)has widespread benefits and costs<br>B)has

Q71: Exhibit 111 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4910/.jpg" alt="Exhibit 111

Q78: The notrade equilibrium in a perfectly competitive

Q98: Your friend notices that U.S.auto production and