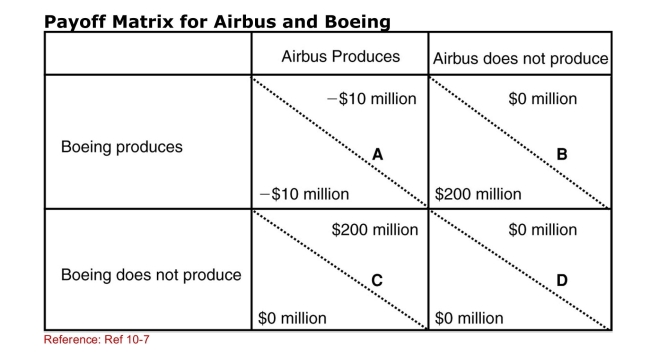

SCENARIO: PAYOFF MATRIX FOR AIRBUS AND BOEING

The payoff matrix supplied shows outcomes of various strategies

That Airbus and Boeing might follow in response to action on the

Part of the other company.This payoff matrix describes actions

In developing socalled superjumbo jets that can carry 600 or

More passengers.In each element, the lowerleft value gives

The outcome for Boeing based on the action of Airbus and the

Upperright value gives the outcome for Airbus based on the

Action of Boeing.For example, in element A, each company will

Lose $10 million if they both decide to produce superjumbo jets.

(Scenario: Payoff Matrix for Airbus and Boeing) Which elements

Are a Nash equilibria?

Definitions:

Equipment

Tangible assets used in operations, such as machinery or office machines, which have a useful life longer than a year.

Straight-Line Method

A depreciation method that allocates an equal amount of the cost of an asset to each year of its useful life.

Fully Depreciated

A term used when a fixed asset has been depreciated to its salvage value and no longer carries a cost on the balance sheet except its possible residual value.

Loss on Disposal

Represents the financial loss a company incurs when it disposes of an asset for less than its carrying value.

Q22: Professor Daniel Trefler at the University of

Q38: What do developing nations expect from wealthy

Q42: What is the best measure of a

Q43: Why do some say labor standards are

Q88: What entries are used to calculate a

Q98: What country was the world's largest exporter

Q103: To explain why some nations purchase products

Q119: The PrebischSinger hypothesis concludes that:<br>A)due to unfair

Q122: Suppose that the Home country in the

Q138: In an autarkic situation, demonstrate that a