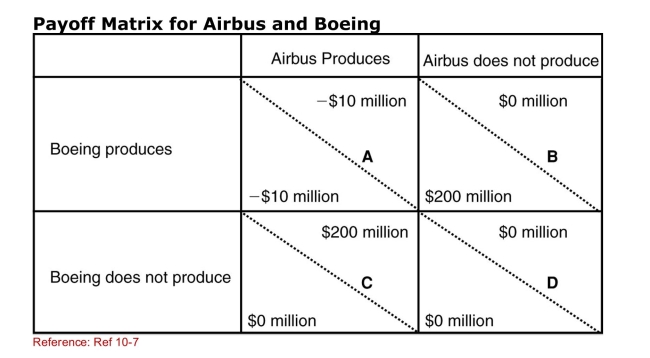

SCENARIO: PAYOFF MATRIX FOR AIRBUS AND BOEING

The payoff matrix supplied shows outcomes of various strategies

That Airbus and Boeing might follow in response to action on the

Part of the other company.This payoff matrix describes actions

In developing socalled superjumbo jets that can carry 600 or

More passengers.In each element, the lowerleft value gives

The outcome for Boeing based on the action of Airbus and the

Upperright value gives the outcome for Airbus based on the

Action of Boeing.For example, in element A, each company will

Lose $10 million if they both decide to produce superjumbo jets.

(Scenario: Payoff Matrix for Airbus and Boeing) Boeing has

Decided not to produce superjumbo jets.Instead, it will

Continue to market its 450passenger 747s.However, Airbus will

Produce superjumbo jets.Which element represents their joint

Decisions?

Definitions:

Net Operating Income

The total operating profit of a company after all operating expenses, excluding taxes and interest expenses, have been deducted from total revenue.

First Year

Refers to the initial period or the first 12 months of a specific timeframe, often used in the context of financial or operational performance.

Absorption Costing

A method of product costing that includes all manufacturing costs, both fixed and variable, in the cost of a product.

Contribution Margin

The amount remaining after variable costs have been subtracted from revenue, which contributes to covering fixed costs and generating profit.

Q27: NAFTA is:<br>A)a free trade area among Mexico,

Q35: Which of the following is included in

Q53: A large nation's export subsidy _ importing<br>Countries'

Q58: The story about the mass slaughter of

Q61: Assume that two countries (Home and Foreign)

Q85: When products from a highcost country within

Q92: In the United States, which of the

Q92: The United States is a significant exporter

Q107: In a prisoner's dilemma:<br>A)all competing parties gain.<br>B)one

Q118: Many regional trade agreements include other provisions