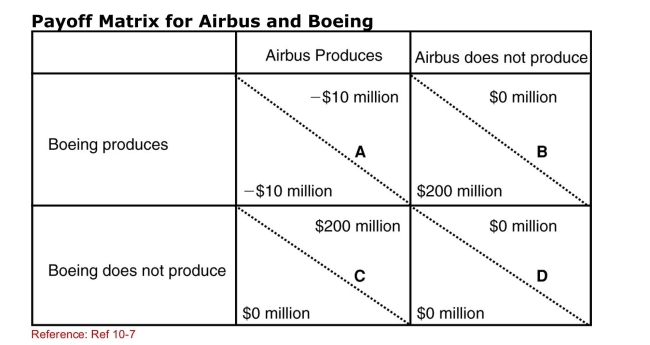

SCENARIO: PAYOFF MATRIX FOR AIRBUS AND BOEING

The payoff matrix supplied shows outcomes of various strategies

That Airbus and Boeing might follow in response to action on the

Part of the other company.This payoff matrix describes actions

In developing socalled superjumbo jets that can carry 600 or

More passengers.In each element, the lowerleft value gives

The outcome for Boeing based on the action of Airbus and the

Upperright value gives the outcome for Airbus based on the

Action of Boeing.For example, in element A, each company will

Lose $10 million if they both decide to produce superjumbo jets.

(Scenario: Payoff Matrix for Airbus and Boeing) Boeing has

Decided not to produce superjumbo jets.Instead, it will

Continue to market its 450passenger 747s.However, Airbus will

Produce superjumbo jets.Is Boeing's decision correct?

Definitions:

Firm Value

The total value of a business, determined by its assets, earnings, and potential in the market.

Call Option Price

The price at which the holder of a call option has the right, but not the obligation, to buy an underlying security before the option expires.

Option Maturity

The date on which an option contract expires, after which it can no longer be exercised.

Lower Bound

The minimum value that a financial instrument, such as an option, can decrease to, taking into account current market conditions.

Q10: A country's factors of production include its:<br>A)labor.<br>B)capital.<br>C)natural

Q28: According to Ricardo:<br>A)all countries can gain from

Q57: A worker's "real" wage is related to:<br>A)his

Q59: An increase in the price of imported

Q59: Why must we know the composition of

Q73: When a firm in an industrial nation

Q108: Which of the following countries is NOT

Q111: The Ricardian model assumes that the marginal

Q134: The WTO (under the GATT agreement) provides

Q140: SCENARIO: DEMAND AND SUPPLY FOR IRON ORE<br>The