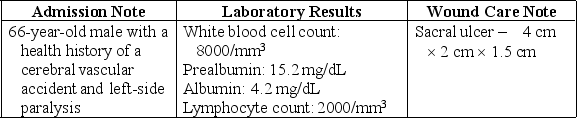

A nurse evaluates the following data in a client's chart:

Based on this information,which action should the nurse take?

Definitions:

AGI

AGI, short for Adjusted Gross Income, is an individual's total gross income minus specific deductions, used to determine how much of one's income is taxable.

Rental Activity

Engaging in the act of renting out property or equipment as a business operation to generate income.

AMT Adjustments

Modifications made to calculate the Alternative Minimum Tax (AMT), aiming to ensure that high-income earners pay a minimum amount of income tax.

Tax Preferences

Provisions in the tax code that allow for certain incomes to be taxed at rates lower than the ordinary income tax rate or not taxed at all.

Q2: A student asks the nurse what is

Q2: A nurse is caring for a client

Q4: A nurse is caring for several clients

Q14: A client has just been diagnosed with

Q15: A nurse evaluates the following data in

Q16: A client has been hospitalized with an

Q17: A nurse answers a call light on

Q17: A nurse is caring for a client

Q21: A home care nurse prepares to administer

Q21: Four clients are receiving tyrosine kinase inhibitors