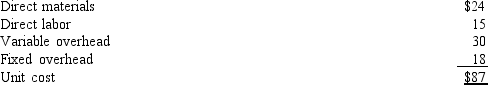

The following information relates to a product produced by Creamer Company:  Fixed selling costs are $500,000 per year, and variable selling costs are $12 per unit sold. Although production capacity is 600,000 units per year, the company expects to produce only 400,000 units next year. The product normally sells for $120 each. A customer has offered to buy 60,000 units for $90 each.

Fixed selling costs are $500,000 per year, and variable selling costs are $12 per unit sold. Although production capacity is 600,000 units per year, the company expects to produce only 400,000 units next year. The product normally sells for $120 each. A customer has offered to buy 60,000 units for $90 each.

If the firm produces the special order, the effect on income would be a

Definitions:

Break-even Sales

The level of sales at which a business generates revenue exactly equal to its costs, resulting in no profit or loss.

Consumer Division

A segment within a company focused on selling products and services directly to consumers, as opposed to business or commercial clients.

Break-even Sales

The amount of revenue needed to cover both the variable and fixed costs of a business, resulting in neither profit nor loss.

Absorption Costing

is an accounting method that includes all manufacturing costs (direct materials, direct labor, and both variable and fixed overhead) in the cost of a product.

Q1: Which of the following is NOT one

Q16: Though Lynn considers her activities to be

Q47: Wilson Custom Cabinetry makes cabinets to order

Q48: Depreciation of equipment is an example of

Q53: Discuss the use of discretion in the

Q55: The dividend payout ratio is equal to

Q70: Common-size analysis expresses each item in a

Q93: The following data have been taken from

Q103: Feline Company uses a normal job-order costing

Q134: _ are actions that violate laws defining