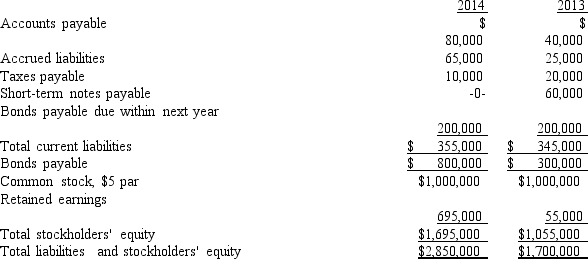

The following information is available from the balance sheets at the end of 2014 and 2013 for Shelley Company:

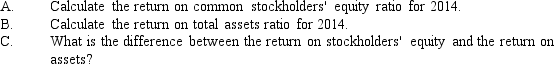

Net income for 2014 and 2013 was $340,000 and $300,000, respectively. Interest expense was $45,000 for 2014 and the tax rate is 30%. Answer the following:

Net income for 2014 and 2013 was $340,000 and $300,000, respectively. Interest expense was $45,000 for 2014 and the tax rate is 30%. Answer the following:

Definitions:

Over/Underabsorbed Overhead

The difference between the overhead costs applied to products and the actual overhead costs incurred.

Income Statement

A financial statement that shows a company's revenues and expenses over a specific period, ending with net income or loss.

Cost Pool

A grouping of individual costs, typically by department or service center, from which cost allocations are made later.

Q45: A normal job-order costing system is a

Q59: When computing the quick ratio, a short-term

Q68: How do NPV and IRR differ?<br>A) NPV

Q92: In terms of operating income for the

Q102: Return on sales is calculated by dividing<br>A)

Q128: The net income reported on the income

Q148: The following information relates to a product

Q152: If the accounts receivable turnover is 42

Q164: Baskin Company's net income last year was

Q168: How are unit costs calculated?<br>A) by dividing