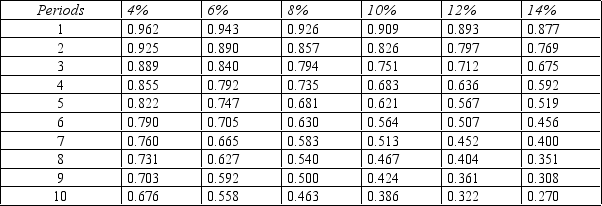

Figure 14-6.Present value of $1

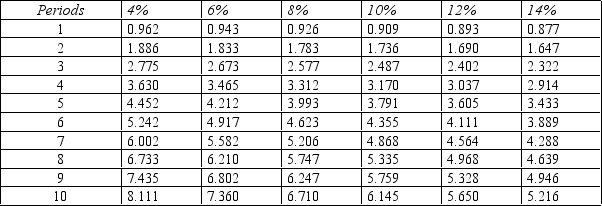

Present value of an Annuity of $1

Present value of an Annuity of $1

-Refer to Figure 14-6. Morgan Clinical Practice is considering an investment in new imaging equipment that will cost $400,000. The equipment is expected to yield cash inflows of $80,000 per year for a six year period. At the end of the sixth year, the firm expects to recover $150,000 from the sale of the equipment. Morgan set a required rate of return at 10%. What is the net present value of the investment? (Note: there may be a rounding error depending on the table you use to compute your answer. Choose the answer closest to the one you calculate.)

Definitions:

Prestigious Institution

A highly respected and often ancient organization known for excellence in a specific field, such as education or research.

Physical Well-Being

A state of health, fitness, and overall well-being in one's body, often achieved through exercise and nutrition.

Obedience Experiment

A study or research design aimed at understanding the extent to which individuals comply with orders or commands, especially from figures of authority.

Surprised Results

Findings in research or experiments that deviate significantly from what was originally hypothesized or expected.

Q1: A static budget compares actual cost with

Q2: Payment of Operating Expenses

Q68: In an activity flexible budget, the variable

Q68: How do NPV and IRR differ?<br>A) NPV

Q78: If a company has both an inflow

Q137: Building an activity-based budget requires<br>A) the activities

Q156: If year one equals $800,000, year two

Q161: When preparing a statement of cash flows

Q165: The _ measures the difference between the

Q182: The use of estimates, cost, alternative accounting