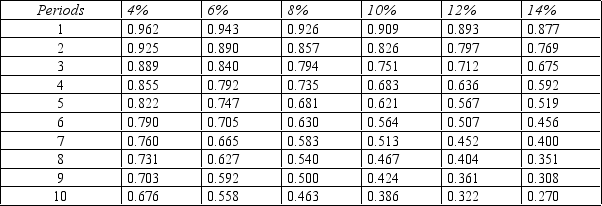

Figure 14-6.Present value of $1

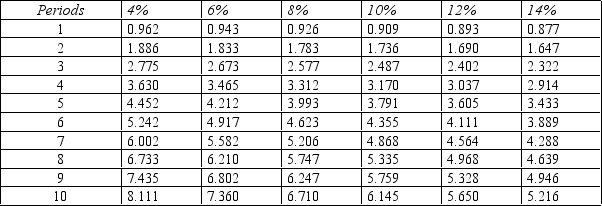

Present value of an Annuity of $1

Present value of an Annuity of $1

-Refer to Figure 14-6. Roman Knoze is considering two investments. Each will cost $20,000 initially. Project 1 will return annual cash flows of $10,000 in each of three years. Project 2 will return $5,000 in year 1, $10,000 in year 2, and $15,000 in year 3. Roman requires a minimum rate of return of 10%. What is the net present value of Project 1? (Note: there may be a rounding error depending on the table you use to compute your answer. Choose the answer closest to the one you calculate.)

Definitions:

Teachers

Professionals who help students to acquire knowledge, competence, or virtue in educational settings.

Factor Market

A marketplace where factors of production such as labor, capital, and natural resources are bought and sold.

Firms

business organizations engaged in the production and sale of goods and services, operating with the motive of earning profits.

Opportunity Cost

The cost of forgoing the next best alternative when making a decision or choosing a particular action.

Q7: Which one of the following would not

Q9: All SEC-registered firms must issue a statement

Q12: The type of analysis that is concerned

Q21: Fixed overhead volume variance

Q29: Which of the following is true regarding

Q71: Land costing $78,000 was sold for $93,000

Q102: Which model is better for independent projects

Q162: The internal rate of return is the

Q164: Which of the following is a reason

Q180: In setting standards, historical experience should be