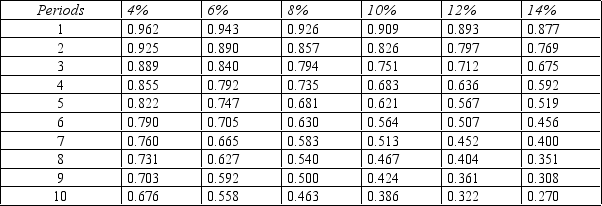

Figure 14-6.Present value of $1

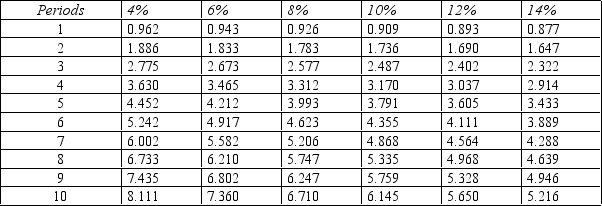

Present value of an Annuity of $1

Present value of an Annuity of $1

-Refer to Figure 14-6. Roman Knoze is considering two investments. Each will cost $20,000 initially. Project 1 will return annual cash flows of $10,000 in each of three years. Project 2 will return $5,000 in year 1, $10,000 in year 2, and $15,000 in year 3. Roman requires a minimum rate of return of 10%. What is the net present value of Project 2?

Definitions:

Equivalent Units of Production

A concept in process costing that converts partially completed products into an equivalent number of fully completed units for inventory accounting purposes.

Q18: _ is the prediction of what activity

Q27: Projects that if accepted preclude the acceptance

Q57: Determining the cash flows from operating activities

Q59: When computing the quick ratio, a short-term

Q65: Last year Fuller Company had a net

Q94: The volume variance is often interpreted as

Q98: Fill in the lettered blanks in the

Q138: Refer to Figure 11-8. Prepare an annual

Q148: Which balance sheet accounts are affected by

Q165: The _ measures the difference between the