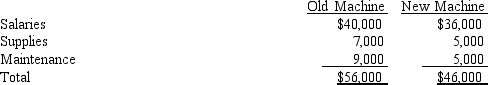

Dale Davis Company is evaluating a proposal to purchase a new machine that would cost $100,000 and have a salvage value of $10,000 in 4 years. It would provide annual operating cash savings of $10,000, as follows:

If the new machine is purchased, the old machine will be sold for its current salvage value of $20,000. If the new machine is not purchased, the old machine will be disposed of in 4 years at a predicted salvage value of $2,000. The old machine's present book value is $40,000. If kept, in 1 year the old machine will require repairs predicted to cost $35,000.

If the new machine is purchased, the old machine will be sold for its current salvage value of $20,000. If the new machine is not purchased, the old machine will be disposed of in 4 years at a predicted salvage value of $2,000. The old machine's present book value is $40,000. If kept, in 1 year the old machine will require repairs predicted to cost $35,000.

Dale Davis's cost of capital is 14%.

Required: Should the new machine be purchased? Why or why not?

Definitions:

Transaction Gains

Refers to the profits realized from the buying and selling of assets or securities within a specific timeframe.

Tax Deductible

Expenses that can be subtracted from gross income to reduce the amount of income subject to tax.

Translation Losses

Financial losses resulting from converting the financial statements of a foreign subsidiary into the parent company's currency.

Foreign Governments

The governing bodies of nations other than one's own, which may interact through diplomacy, trade, and other forms of engagement.

Q14: Several transfer pricing policies are used in

Q32: _ occur whenever actual prices or actual

Q65: Use the following information to perform the

Q77: Mover Company has developed the following standards

Q78: Jones Company is considering the purchase of

Q131: An after-the-fact flexible budget allows managers to

Q139: Economic value added is just a specific

Q159: For meaningful analysis, ratios should be compared

Q166: If actual fixed overhead was $54,000 and

Q172: Which one of the following is not